Finance

Bank

Mathematics and Economics

- Economy

- Finance

- Capital market

- Banking

- Mathematics

- Statistics

- Logic

Academy that finds its driving force in finance and which, located in this segment, aims to awaken and sharpen students’ curiosity in relation to the topics included in discussions of this nature.

It is, therefore, one more of the business academies of the Germinare BUSINESS school in which practice and theory are inseparable. To this end, the Finance Academy makes use of multidisciplinary projects and constant contact with professionals in this area, thus working on economic concepts (local and international), enabling students to develop their ability to solve problems and enabling the acquisition of knowledge about banking and financial products and services.

Therefore, at the end of their training, students acquire the necessary skills to obtain Anbima certifications:

• CEA (Anbima Investment Specialist Certification) – which qualifies financial market professionals to act as investment specialists;

• CPA-20 (Professional Certification Anbima Series 20) – intended for professionals who work in the distribution of products and investments for clients in the high-income retail, private and corporate< segments /em> and to institutional investors in bank branches or service platforms.

Germinare B3 is a project developed from the partnership between the J&F Institute, Comncor and B3, in which students have limits to operate the Ibovespa Futuro. Participation is optional for students in the 1st and 2nd years of high school at all the business academies of the Germinare BUSINESS school.

In 2022, an asset management linked to the J&F Institute was created, which aims to develop students from the Germinare BUSINESS school to manage a third-party resource manager , being open to future shareholders, so that they can compete in the Brazilian market and, subsequently, in the global market.

Banco Original’s trajectory began in September 2021, when 27 students from the business school went through different areas of the bank, such as onboarding, UX, digital acquisition, xRM, commercial planning, central customer service, cards, loans, insurance, current account, credit desk, investments and marketing.

As a conclusion to the job rotation, the students were divided into five groups, in which each group received a real problem from Banco Original to think about solutions that could be implemented, always focusing on the customer and earnings financial.

The chosen areas were digital acquisition, billing, credit, costs and products.

students and former students working in a practical way in the business

students operate on the Bovespa Index in a project shared with Banco B3

students with CPA (Professional Certification Series 20 Anbima)

students with CEA (Anbima Certification of Investment Specialists)

Dados de 2022

ACADEMY OF FINANCE

Graduated in civil engineering from Instituto Mauá

Trainee/system analyst at Itaú

Treasurer Brazil – BankBoston

Partner at Quantix Investimentos

Partner at Kinea Investimentos

Director of the Finance Academy

Develops students to manage a third-party asset manager, open to future shareholders, to compete in the Brazilian market and, later, in the global market.

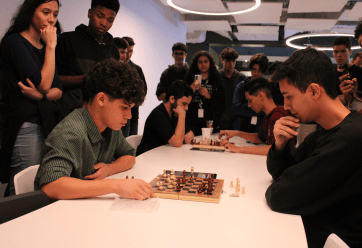

Championship created by the director of the Academy of Finance, Sérgio Gabriele, together with the librarian of the J&F Institute, Janete Marques, and the professor of Communication at the Academy of Brands, Laisa Andrade, when they saw the number of students who played chess during class breaks classes.

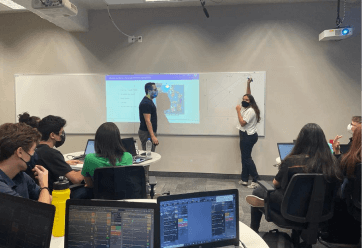

The curricular component uses inverted classes as an active methodology, in which students are responsible for discussions on economics and global politics, and teachers only mediate discussions and give them directions, when necessary.

Aimed at the 7th grade classes of the Finance and Digital Business Academies at the Germinare BUSINESS school, this is a project in which students create a bank, developing the brand, target audience, banking products, rates and fees, DRE, balance sheet assets, investor relations and ESG.

Project developed from the partnership between Instituto J&F, Comncor and B3, in which students have limits to operate Ibovespa Futuro. The objective is to develop in students the sensitivity to understand market information, risk and return perception and knowledge of B3 products.

Monitoring carried out to help students solve their doubts about mathematics, logic and geometry.